You can find the Link to trading strategies lists by the End of this Article

Trading in the financial markets can be exciting, challenging, and potentially rewarding. However, to be successful in trading, you need to have a solid trading strategy. A trading strategy is a set of rules and guidelines that you follow to make informed trading decisions. In this article, we will discuss some popular trading strategies that can help you become a successful trader.

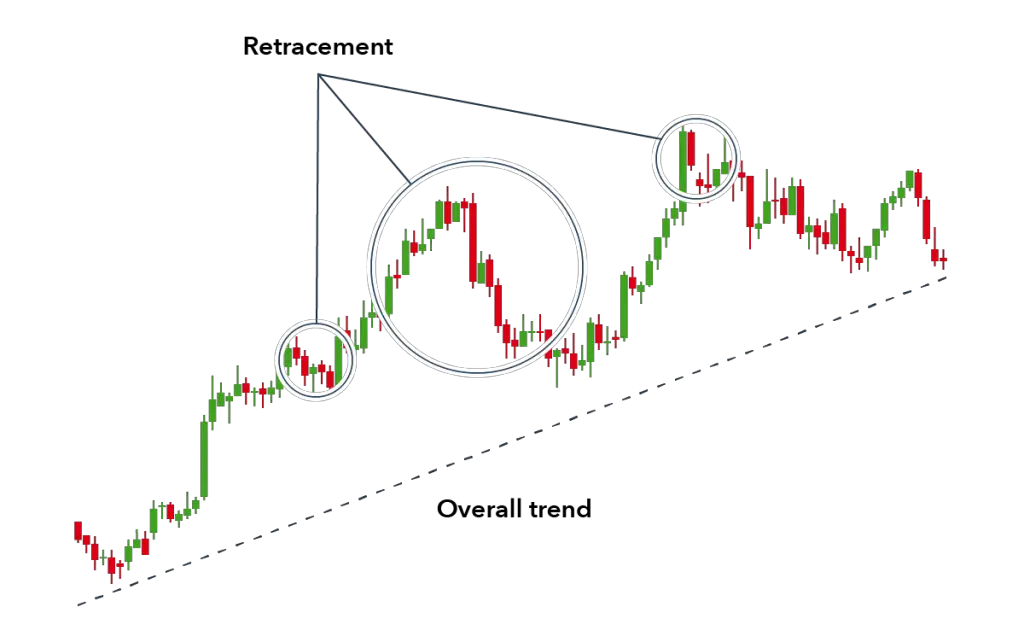

Trend Following Strategy

The trend following strategy is one of the most popular trading strategies. It involves identifying the direction of a market trend and trading in the same direction. This strategy is based on the belief that markets tend to move in trends, and traders can profit by riding these trends. To implement this strategy, traders use technical analysis tools such as moving averages and trend lines to identify the direction of a trend.

Breakout Strategy

The breakout strategy is another popular trading strategy. It involves identifying a price level at which a security has been trading for a period of time and waiting for a breakout to occur. A breakout occurs when the price moves above or below the price level, indicating a potential trend reversal or continuation. To implement this strategy, traders use technical analysis tools such as support and resistance levels to identify potential breakout points.

Swing Trading Strategy

The swing trading strategy is a medium-term trading strategy that involves holding positions for a few days to a few weeks. This strategy is based on the belief that markets tend to move in cycles, and traders can profit by trading the swings in the market. To implement this strategy, traders use technical analysis tools such as chart patterns and indicators to identify potential swing points.

Scalping Strategy

The scalping strategy is a short-term trading strategy that involves holding positions for a few seconds to a few minutes. This strategy is based on the belief that small price movements can be exploited for profit. To implement this strategy, traders use technical analysis tools such as tick charts and order flow to identify potential scalping opportunities.

Position Trading Strategy

The position trading strategy is a long-term trading strategy that involves holding positions for several months to several years. This strategy is based on the belief that markets tend to move in cycles over the long term, and traders can profit by trading these cycles. To implement this strategy, traders use fundamental analysis to identify undervalued or overvalued securities and hold them for the long term.

Google Docs

To Access Google DOC For Trading Strategies, list Click Here .

To Access Google DOC For Backtest Sample Click Here.

Conclusion

Successful trading requires a solid trading strategy that takes into account your goals, risk tolerance, and trading style. The trading strategies discussed in this article are just a few examples of the many strategies that traders use to make informed trading decisions. It’s important to remember that no trading strategy is foolproof, and that successful traders are always learning and adapting to changing market conditions. With the right mindset and a sound trading strategy, you can become a successful trader in the financial markets.